Insurance Management System Free Source code

Abstract

Table of Contents

People are surviving by taking use of what technology has to offer as we move toward a smarter, more digital society. Living in a technologically evolved environment has several benefits, one of which is the ability to automate transactions. Companies and organizations that deal with tasks and operations frequently tend to carry them out rather laboriously and challengingly. It takes a lot of work to perform and process insurance; there are many factors to take into consideration and a lot of data to encode and record. The researchers come up with the idea for the “Insurance Management System” capstone project to address this issue. A platform that organizes the management of the agents for resources and insurance. Organizations that manage insurance policies for individuals are no longer able to manage operational annoyance because the system can handle it on its own. It provides capabilities for quickly and effectively processing data. Spread sheet software is typically used by enterprises to record and administer insurance; however it is unsecure and can result in data breaches because anyone can easily change the data and record false information. For this reason, the researchers came up with the idea of creating the capstone project. The primary objective of the study is to effectively and efficiently design and construct the “insurance management system.” The researchers will construct a project using the Software Development Life Cycle (SDLC) method. The researcher will test and check the app after it has been developed to confirm its functionality and seamless operation. A panel of IT specialists will review the developed application for future enhancement and improvement.

Project Context

The “Insurance management system” capstone project is a systemized platform that controls the resources and personnel who deal with insurance. Organizations that manage insurance policies for individuals are no longer able to manage operational annoyance because the system can handle it on its own. It provides capabilities for quickly and effectively processing data. The platform will take a lot of aspects and mistakes into account when making corrections, thus a lot of misconceptions and improper operations that are visible in a simple style of managing insurance will be rejected. This is a system that can be easily accessed by both end users and online page visitors. This technology will benefit both insurance companies and policyholders since it will enable them to effectively monitor and manage their insurance without having to deal with the hassle of doing so in a laborious and physical way.

Our readers are also interested in this item: Invoice Management System Database Design

An organization may have difficulties that make managing insurance ineffective, leading to mistakes, discrepancies, and data loss. Spread sheet software is typically used by enterprises to record and administer insurance; however it is unsecure and can result in data breaches because anyone can easily change the data and record false information. Although it could be recorded on a software platform, the data wouldn’t be of long-term value. This ineffective technique of encoding, documenting, and monitoring insurance for a business or organization could have a number of negative effects. For this reason, the researchers came up with the idea of creating the capstone project. Because they lack the platform to readily check and monitor the state of their insurance, those who have insurance tend to not adequately monitor it.

Proposed Solution

Insurance providers and policyholders still encounter difficulties managing a variety of operations, particularly when coming up with solutions and choosing actions that will enable the management of the aforementioned insurance operations to be completed successfully. The study’s authors suggested a “insurance management system” as a remedy for the aforementioned issues with managing insurances. This system enables an individual or business dealing in insurance to manage claims comprehensively and correctly in an effective and convenient manner. Being aware of how insurance companies often provide their services to both their clients and other businesses, as well as how they maintain track of it. As a result, this system will be a fantastic solution because it can easily monitor their operations because it records and holds the data required for that particular operation, such as updating the policy, the health plan, the life plan, and other fundamental resources that are needed in the insurance.

Our readers are also interested in this item: Law Office Management Information System in Bootstrap and PHP Script

Objectives of the study

General objective- the main goal of the study is to design and develop the “insurance management system” in a very effective and efficient manner.

Specifically the system aims to:

- To develop a system that will house well-organized data for the many activities and operations involved in managing an insurance company.

- To create a system that secures, manages, and grows the activities and transactions carried out by those in charge of insurance.

- Insurance management transactions for administrators and users won’t be complicated by the system’s user-friendly interface, which is easy to use.

- To design a very user-friendly system.

- This project’s objective is to deliver a thorough, trustworthy, and secure record of all data.

Scope of the study

The goal of this study is to develop a “Insurance Management System” that will benefit both individuals and businesses who deal with insurance. There will be two end users: the company’s admin and then clients or people. The administrator can add, remove, and examine the customer’s information as well as regulate and monitor the customer’s insurance and the business. The system will be used to keep track of records and monitor transactions in order to make them more safe and effective. On the other hand, customers can also create an account and log in, even without the approval of the administrator.

Significance of the study

The following individuals or groups will benefit from the success of the project:

Insurance Company: As one of the system’s intended users, they stand to gain significantly from its implementation. With the help of the system, they will have a quick, effective, and secure platform to store data, enabling them to effectively oversee and manage the organization’s insurance operation. There won’t ever again be any data security breaches, inconsistencies, or errors. Unavoidable busy work makes it difficult for employees to handle their workload directly, correctly, and effectively, which renders them unproductive and reduces the value of the company. The advantages of the study are the exact opposite of the adherence that was stated because they address everything and increase staff productivity.

Researchers: The system will assist them in learning more and improving their skills and expertise in order to create successful programs.

Future Researchers: The study will be used as a guide or reference for making changes to the project or possibly developing their own version of it.

Development Tools

The capstone project, “Insurance Management System” is intended to serve as a platform to manage insurances in an organization and individuals.

This post will provide you with an idea of what forms should be included in an Insurance Management System

The project documentation is available upon request (chapters 1 to 5). Please contact us if you require the whole project documents.

Our readers are also interested in this item: Top 40 Free Business Related IT Capstone Project

Project Highlights

The “Insurance Management System” will manage the process of managing article insurance operations and users. The software will increase operational efficiency and user satisfaction.

The system has the following benefits:

- Automated Management – records management, users transactions, and report preparation are all lot easier to handle.

- Records Management – a database system that makes order records electronic, safe, dependable, and rapid.

- Generation of Reports – The system may generate real-time reports related on insurance operations.

How the System Works

This article will present the features and functions of the system. The researcher will discuss the forms, modules and user interface of the system.

Homepage – this form displays the customer and admin page.

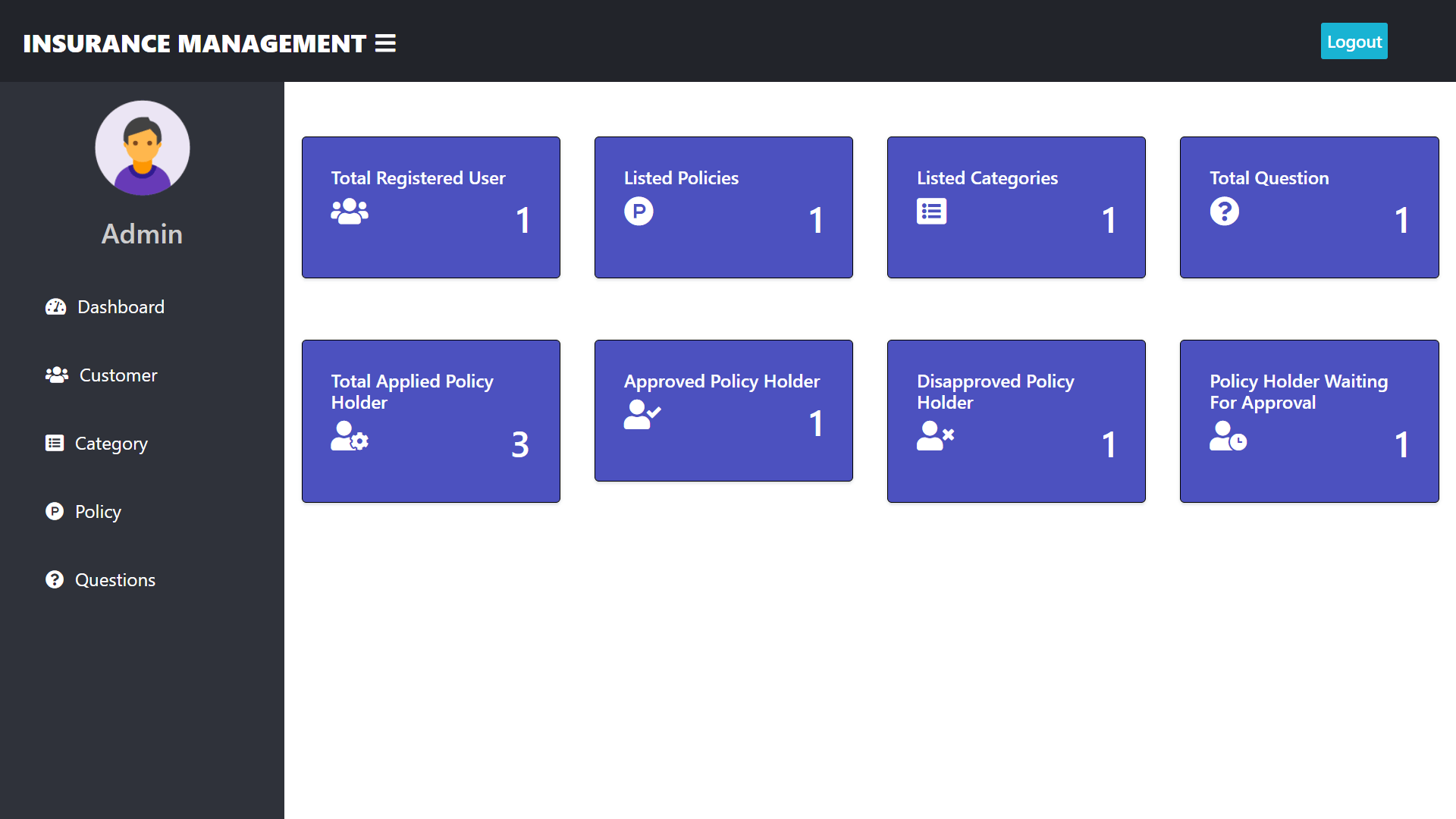

Admin Dashboard– this serves as the main page of the system administrator, the major records of the system are displayed in this page in which the admin can access and manage.

The following are mainly displayed in the dashboard:

- Total registered User

- Listed policies

- Listed categories

- Total question

- Total applied policy holder

- Approved policy holder

- Disapproved policy holder

- Policy holder waiting for approval

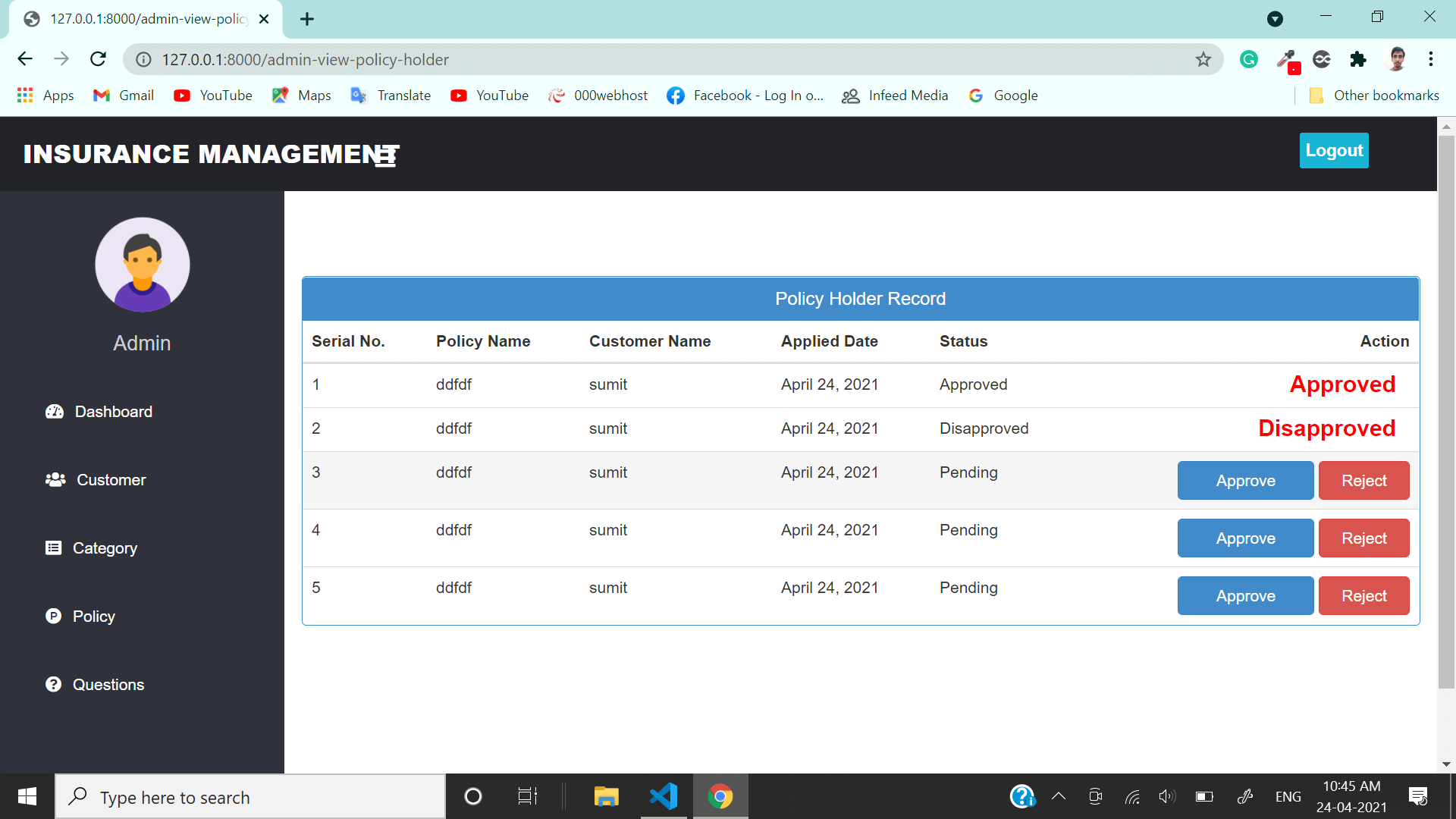

Policy Record– this form displays the following:

- Serial Number

- Policy name

- Customer name

- Applied date

- status

Policy– this form will display the following terms:

- view policy

- add policy

- update policy

- delete policy

- total applied policy holder

- approved policy holder

- disapproved policy holder

- Policy holder waiting for approval

Conclusion

The experts claim that the current strategy is ineffective and demands too much time and effort from both parties. In order to help those end users who might profit from it, the researchers developed an Insurance Management System Solutions and made it available to them. By guiding and aiding people in making their work easier, developing technology-based solutions will always be effective and successful in meeting people’s requests. Evaluation of the current method for handling individual tasks, time, and work was the study’s main objective. The study’s conclusions showed that the constructed system met the needs and requirements of the respondents and end-users. According to the aforementioned benefits and features, system deployments will unquestionably be successful and efficient.

Recommendations

The researchers fervently support the implementation of the system as a result of the study’s impressive findings. The system is suggested by the professionals due to its effectiveness and dependability for end users. The system should be adopted, installed, and used by the target users primarily for the purpose of easy asset management transaction monitoring and asset data and information storage. Utilizing the method will make managing insurance easier, quicker, more accurate, safe, and more practical. Because it speeds up and streamlines management processes and operations, the system is highly recommended. It is advised that the system be implemented and used to prevent the errors and inconsistencies that the outdated management processes caused after a number of problems with manual transactions.