Tokenized Real Estate Platform

Table of Contents

- Tokenized Real Estate Platform

- What Is a Tokenized Real Estate Platform?

- The Problem with Traditional Real Estate Investment

- 1. High Capital Requirements

- 2. Limited Liquidity

- 3. Complex Legal Processes

- 4. Lack of Transparency

- How Tokenized Real Estate Works

- Step 1: Property Selection and Evaluation

- Step 2: Asset Tokenization

- Step 3: Token Offering

- Step 4: Ownership Recording

- Step 5: Secondary Market Trading

- Key Features of a Tokenized Real Estate Platform

- 1. Fractional Ownership

- 2. Blockchain-Based Transactions

- 3. Smart Contract Automation

- 4. Investor Dashboard

- 5. Compliance and Identity Verification

- Benefits of Tokenized Real Estate

- Increased Accessibility

- Improved Liquidity

- Enhanced Transparency

- Lower Transaction Costs

- Global Investment Opportunities

- Use Cases of Tokenized Real Estate Platforms

- 1. Residential Property Investment

- 2. Commercial Real Estate

- 3. Real Estate Crowdfunding

- 4. Rental Income Distribution

- 5. Land and Agricultural Investments

- Core System Modules

- 1. User Management Module

- 2. Property Management Module

- 3. Tokenization Engine

- 4. Investment Module

- 5. Marketplace Module

- 6. Payment and Distribution Module

- Technology Stack

- Frontend

- Backend

- Database

- Blockchain Layer

- Security

- Security and Compliance Considerations

- Regulatory Compliance

- Data Protection

- Smart Contract Security

- Challenges and Limitations

- Regulatory Uncertainty

- Market Adoption

- Technical Complexity

- Liquidity Dependence

- Future of Tokenized Real Estate

- Conclusion

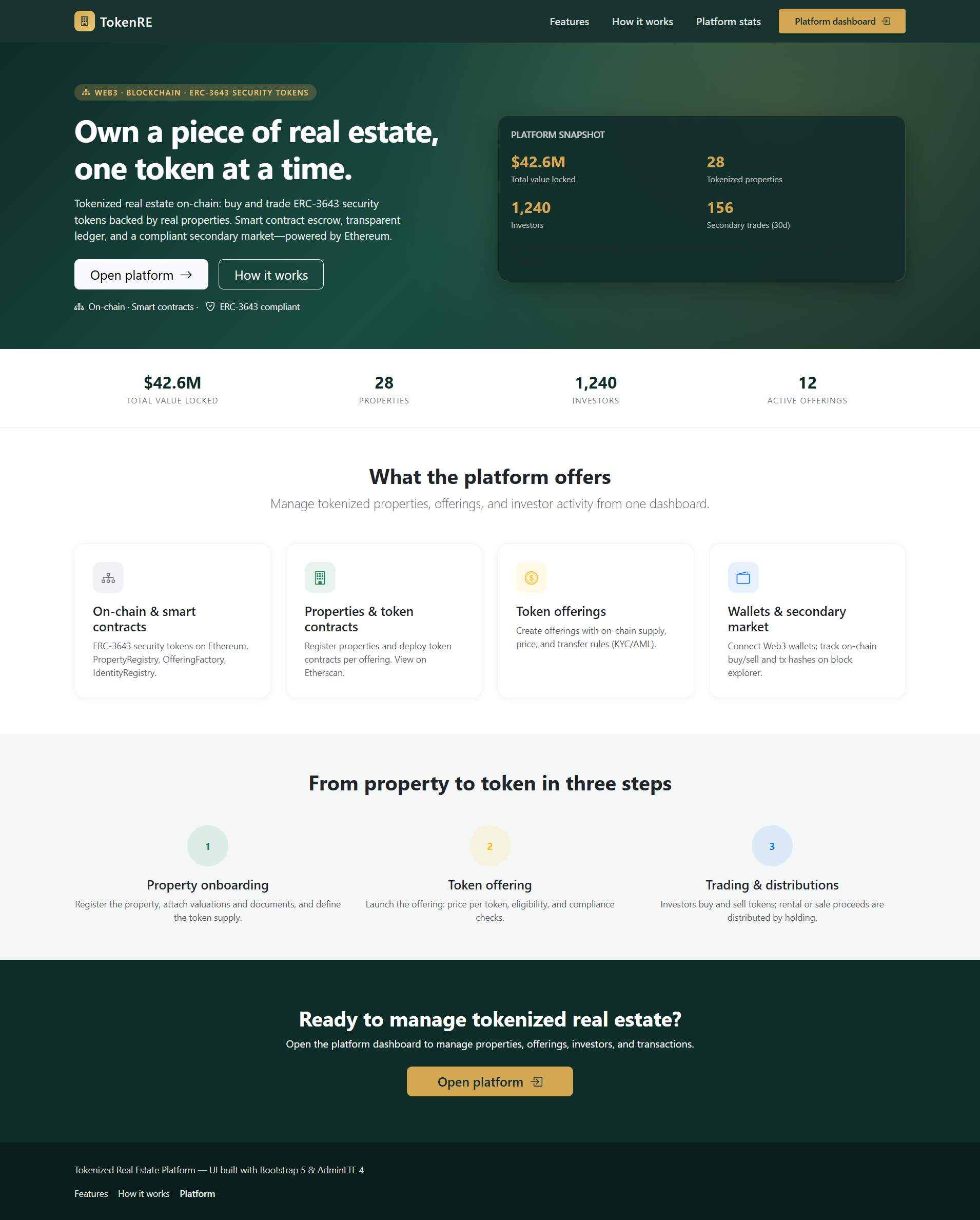

The real estate industry has long been considered one of the most stable and profitable investment sectors. However, it has also been known for high entry barriers, complex legal processes, and limited liquidity. Traditional property investment often requires significant capital, lengthy paperwork, and intermediaries such as brokers, banks, and legal professionals.

A Tokenized Real Estate Platform introduces a modern solution by leveraging blockchain technology to divide property ownership into digital tokens. These tokens represent fractional ownership, enabling investors to purchase small portions of real estate assets. This approach democratizes access to property investments and introduces a more efficient, transparent, and accessible real estate ecosystem.

What Is a Tokenized Real Estate Platform?

A tokenized real estate platform is a digital system that converts property ownership into blockchain-based tokens. Each token represents a share or percentage of a real estate asset, such as residential units, commercial buildings, or land.

Instead of purchasing an entire property, investors can buy tokens equivalent to a fraction of the asset. This allows:

- Lower investment thresholds

- Increased market liquidity

- Faster transactions

- Transparent ownership records

All transactions and ownership changes are recorded on the blockchain, ensuring immutability, security, and traceability.

The Problem with Traditional Real Estate Investment

Despite its potential for long-term returns, traditional real estate investment faces several limitations:

1. High Capital Requirements

Purchasing property often requires large upfront investments, making it inaccessible to small or first-time investors.

2. Limited Liquidity

Real estate is considered an illiquid asset. Selling property can take months or even years, depending on market conditions.

3. Complex Legal Processes

Property transactions involve extensive paperwork, legal verification, and multiple intermediaries, increasing costs and delays.

4. Lack of Transparency

Ownership records may be fragmented, outdated, or vulnerable to fraud in certain regions.

A tokenized platform addresses these challenges by digitizing and automating key processes.

How Tokenized Real Estate Works

The process of tokenizing a real estate asset typically involves the following steps:

Step 1: Property Selection and Evaluation

A property is selected and undergoes valuation, legal verification, and due diligence.

Step 2: Asset Tokenization

The property is divided into digital tokens using blockchain technology. Each token represents fractional ownership.

Step 3: Token Offering

Tokens are offered to investors through the platform. Investors can purchase tokens using fiat or cryptocurrency.

Step 4: Ownership Recording

All ownership data is recorded on the blockchain, ensuring transparency and immutability.

Step 5: Secondary Market Trading

Investors can sell or trade their tokens on a secondary marketplace, improving liquidity.

Key Features of a Tokenized Real Estate Platform

1. Fractional Ownership

Investors can buy small portions of a property instead of the entire asset, lowering the entry barrier.

2. Blockchain-Based Transactions

All transactions are securely recorded on the blockchain, reducing fraud and enhancing trust.

3. Smart Contract Automation

Smart contracts automate processes such as:

- Dividend distribution

- Ownership transfers

- Rental income allocation

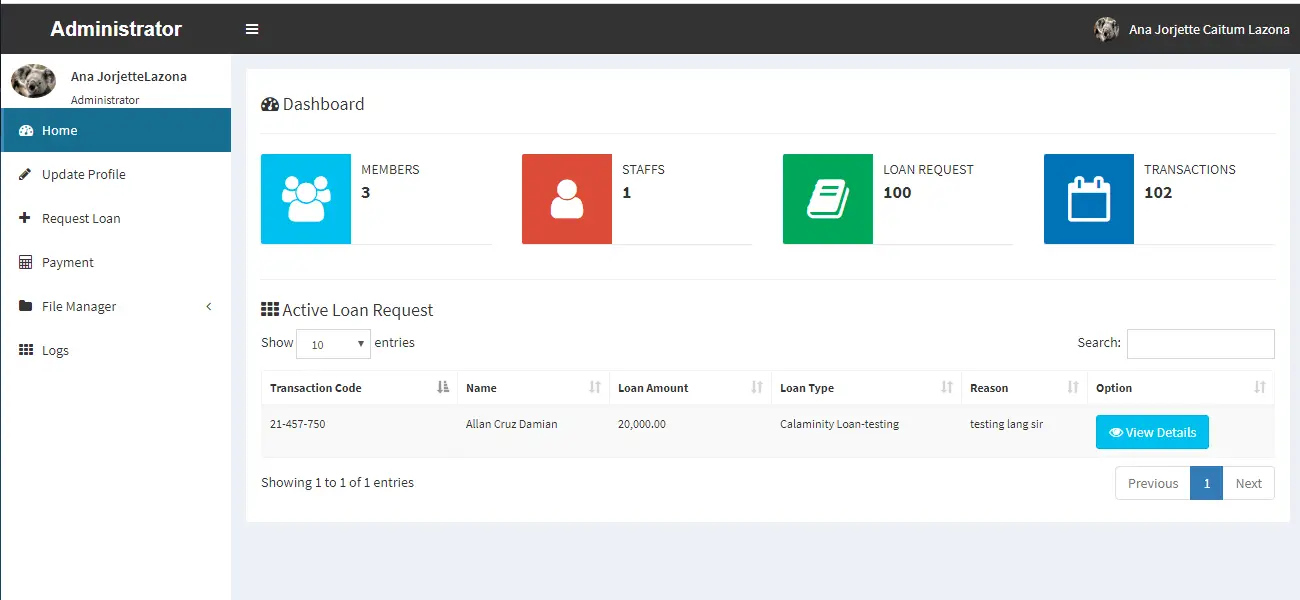

4. Investor Dashboard

A user-friendly dashboard allows investors to:

- View portfolio performance

- Track rental income

- Monitor asset value

- Trade tokens

5. Compliance and Identity Verification

The platform includes:

- KYC (Know Your Customer) verification

- AML (Anti-Money Laundering) compliance

- Secure user authentication

Benefits of Tokenized Real Estate

Increased Accessibility

Tokenization allows investors to participate in real estate markets with smaller capital, opening opportunities to a wider audience.

Improved Liquidity

Investors can trade tokens on secondary markets, enabling faster exits compared to traditional property sales.

Enhanced Transparency

Blockchain ensures that all transactions are recorded and verifiable, reducing the risk of fraud.

Lower Transaction Costs

Automation and reduced reliance on intermediaries lower overall transaction fees.

Global Investment Opportunities

Investors can access real estate assets in different regions without geographical restrictions.

Use Cases of Tokenized Real Estate Platforms

1. Residential Property Investment

Investors can buy shares in apartment units or housing developments.

2. Commercial Real Estate

Office buildings, retail spaces, and hotels can be tokenized for fractional investment.

3. Real Estate Crowdfunding

Developers can raise capital by offering tokenized shares of upcoming projects.

4. Rental Income Distribution

Investors receive automated rental income based on their token holdings.

5. Land and Agricultural Investments

Large land assets can be divided into tokens, enabling smaller investors to participate.

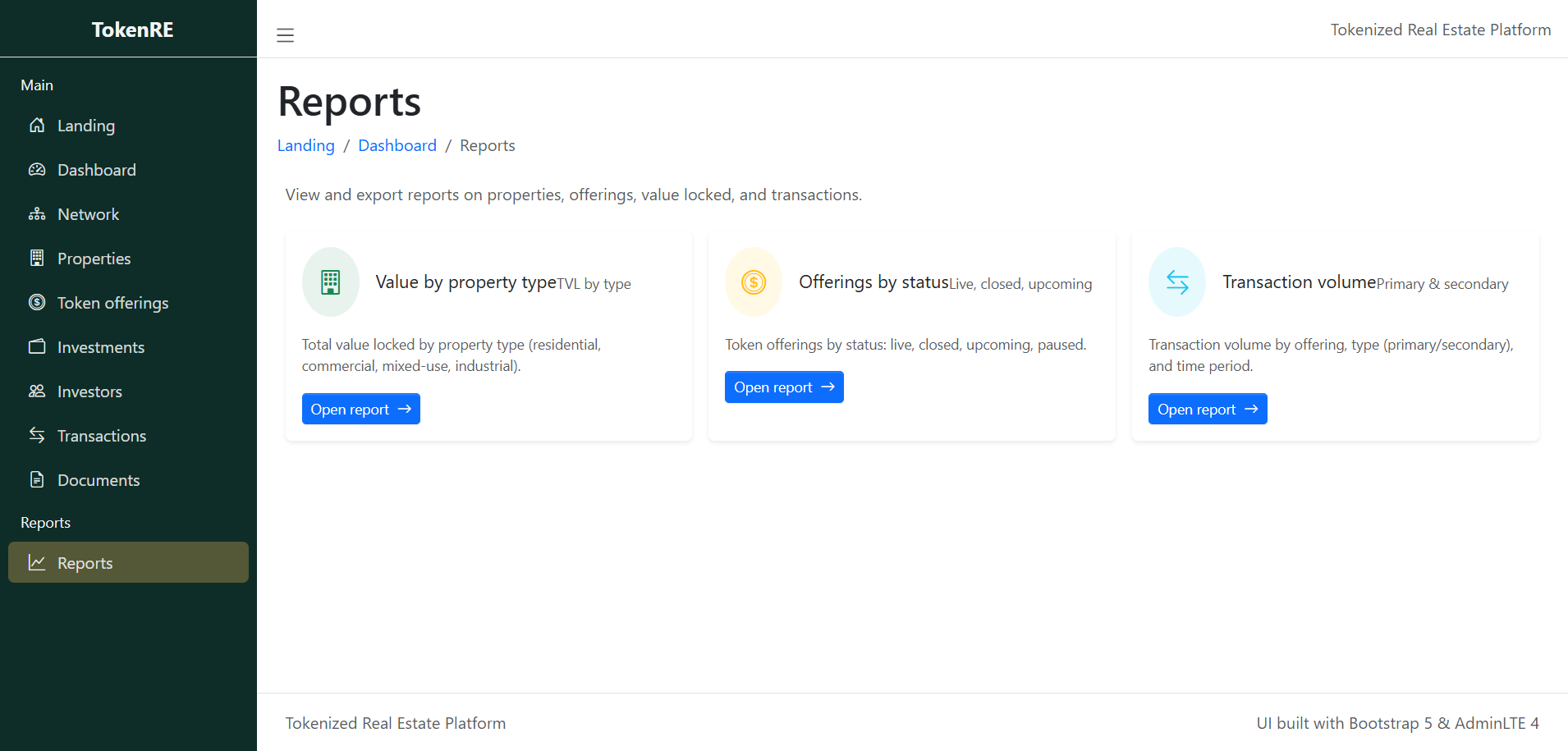

Core System Modules

A typical tokenized real estate platform includes the following modules:

1. User Management Module

- Registration and login

- KYC verification

- User roles and permissions

2. Property Management Module

- Property listings

- Asset valuation data

- Document storage

3. Tokenization Engine

- Creation of property tokens

- Smart contract deployment

- Token supply management

4. Investment Module

- Token purchase system

- Portfolio tracking

- Transaction history

5. Marketplace Module

- Secondary token trading

- Buy/sell orders

- Market analytics

6. Payment and Distribution Module

- Rental income distribution

- Dividend management

- Payment integration

Technology Stack

A tokenized real estate platform typically uses modern web and blockchain technologies:

Frontend

- HTML5, CSS3, JavaScript

- Bootstrap

- AdminLTE dashboard template

Backend

- PHP, Python, or Node.js

- RESTful API architecture

Database

- MySQL or PostgreSQL

Blockchain Layer

- Ethereum or similar smart contract platforms

- ERC-20 or ERC-721 token standards

Security

- SSL encryption

- Multi-factor authentication

- Smart contract auditing

Security and Compliance Considerations

Since tokenized real estate involves financial transactions and digital assets, security and compliance are critical.

Regulatory Compliance

- Adherence to local securities laws

- Investor eligibility verification

- Legal structuring of tokenized assets

Data Protection

- Encrypted storage of user data

- Secure authentication systems

- Regular security audits

Smart Contract Security

- Code reviews and testing

- Third-party audits

- Bug bounty programs

Challenges and Limitations

Despite its advantages, tokenized real estate platforms face several challenges:

Regulatory Uncertainty

Many jurisdictions are still developing regulations for tokenized assets and digital securities.

Market Adoption

Tokenized real estate is still an emerging concept, and widespread adoption may take time.

Technical Complexity

Developing secure blockchain systems requires specialized expertise.

Liquidity Dependence

Secondary market liquidity depends on user adoption and trading activity.

Future of Tokenized Real Estate

Tokenization is expected to play a major role in the future of property investment. As blockchain adoption increases, tokenized real estate platforms may:

- Enable global property marketplaces

- Reduce reliance on traditional intermediaries

- Provide instant settlement of transactions

- Improve transparency in land and property ownership

Governments, developers, and investors are increasingly exploring tokenization as a way to modernize the real estate sector.

Conclusion

A tokenized real estate platform represents a significant shift in how property investments are managed and accessed. By combining blockchain technology with real estate assets, the platform enables fractional ownership, improves liquidity, and enhances transparency.

This innovative approach opens the door for a new generation of investors while streamlining processes for property developers and asset managers. As the technology matures and regulations become clearer, tokenized real estate is poised to become a key component of the global investment landscape.

You may visit our Facebook page for more information, inquiries, and comments. Please subscribe also to our YouTube Channel to receive free capstone projects resources and computer programming tutorials.

Hire our team to do the project.